Debit and Credit Notes

Introduction

Debit and Credit Notes are a

part and parcel of daily transactions of any business. In simple words, when

there are Sales Returns or Purchase Returns in a business, debit and credit notes

are used. There is not a single business that does not have any kind of debit

and credit notes.

Concept of Debit & Credit Note

The need for debit note and

credit note arises most of the time when there is a Return of Goods. Usually

when there is a return of goods, the person does not directly give the cash for

the returned goods. He issues Credit Note if he is a seller and the buyer

issues a Debit Note for the same transaction to the seller from whom he has

received credit note.

Example of Credit and Debit Note

For a better understanding let us take a simple routine business transaction as an example. This is in simple terms is called sales returns entry in Tally or purchase returns entry in Tally. I SOLD goods worth ₹15,000 to Jugal. After checking the goods he did not liked the goods worth ₹5,000 and RETURNED to me. Therefore in this case, I will not give him directly the cash because it will reduce overall sales. Instead, I will give him credit worth ₹5,000 to him using which Jugal can buy anything from me to the extent of ₹5,000 without paying me anything in future.

Note: The

document that I will give him as a proof to buy anything up to ₹5,000 without

paying a single rupee is in fact the Credit Note.

This is the real concept of a

credit note. So what is a debit note? Well, it is exact opposite of a credit

note. Let us continue with this example to understand the concept of a debit

note. As I issued a Credit Note, at the same time Jugal will issue Debit Note

to me for the same transaction. Jugal has returned goods worth ₹5,000 to me and

he will issue a debit note for that amount. Therefore, Jugal will show debit

balance of me in his books. This is because Jugal has already paid for the

goods but has returned some of them. On the other hand, I will show credit

balance of Jugal in my books. The reason for credit balance is because I have

received the goods in return as well as money for that goods from Jugal. So, now

I am liable to pay the money or goods to Jugal. This is the real crux behind

debit and credit note.

Debit and Credit Notes in Tally

For using debit and credit

notes in Tally, you would have enable them. To enable the option for debit and

credit notes in Tally, follow the steps below.

§ From Gateway of Tally, press F11 (Shortcut for Company

Features)

§ Now select, Accounting Features or press F1.

§ Under Invoicing, set the option Use debit/credit notes to YES.

§ Also set YES for:

o Use invoice mode for credit notes

o Use invoice mode for debit notes

Creating a Credit Note in Tally

I have sold goods worth

₹15,000 to Jugal but he doesn’t like certain goods and he is returning the

goods to me worth ₹5,000. For this, I won’t give the ₹5,000 back and I will

issue Credit Note to Jugal. Here is what I will do it in Tally:

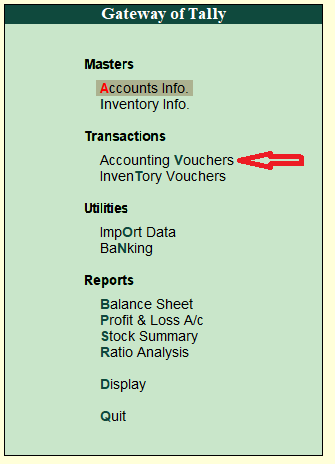

· From Gateway of Tally, I will go to Accounting

Vouchers.

· After entering the Accounting Vouchers, I will go and select

Credit Note. I can select Credit Note in 2 ways. Either by clicking on it or by

shortcut which is CTRL+F8.

After you are in the credit

note voucher, the screen in Tally would look something like this:

Note: If the

supplier does not issue a credit note then what you have to do is cancel the Purchase

Entry for which no credit note is issued. Do the next entry at the reduced amount

of the next purchase.

Creating a Debit Note in Tally

A credit note for me is a

debit note for Jugal as per this example. After clicking on the Debit NoteVoucher, the screen will be as:

You can also see the video regarding "Debit and Credit Notes"

Recommended Articles

Comments

Post a Comment