Debit/Credit Notes, Memorandum & Post Dated Vouchers

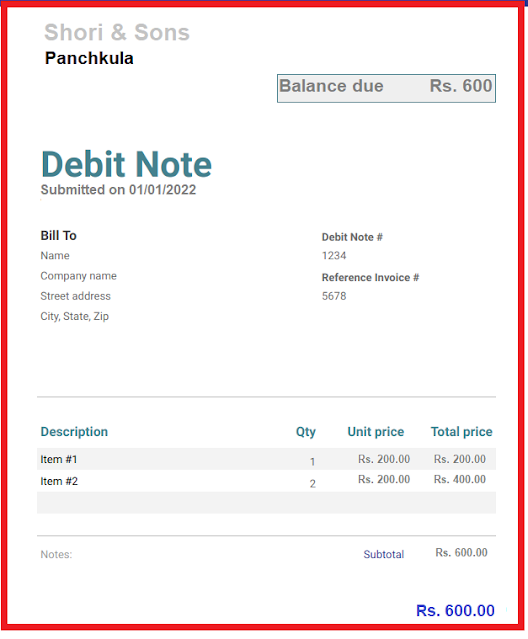

In Tally what happens when you sell something but a customer returns the product or returns only a part of the product? That’s where you use credit notes and you can use easily create a credit note in Tally because there is a specific voucher in Tally just for that. In a similar way, let’s say you purchased a product and didn’t liked the product so you return the product. In this case, you will create a debit note in Tally.

For example, you have put aside

₹10,000 for your monthly business or job expenses. But you are not sure whether

it will be exactly ₹10,000 or ₹9,000 or more than ₹10,000. In this case, if you

pass the accounting entry in Tally for ₹10,000, you will be creating a wrong

entry and it will reflect wrongly in your accounts as well. So, here you can use

memorandum voucher in Tally for passing these kinds of entries.

Note: The

main feature of memorandum vouchers is that it does not affect your accounts nor

reflect on your Balance Sheet unless you convert it to a general voucher. It is

a kind of memo in Tally but in the form of an accounting entry.

There are many situations

like the one above in which we are not sure what will be the exact amount for

the entry. In all those cases, we can use the memorandum voucher. What if you get

a cheque today but the date on the cheque is 10 days from now. It is a

postdated cheque and giving postdated cheques are very common. In this case,

you can create a postdated voucher in Tally. Not just for postdated cheques,

you can use it for any entry which is postdated in Tally.

Recommended Articles

Comments

Post a Comment