Personal Accounts in Tally

Introduction

You can easily maintain personal accounts in Tally. To

maintain personal accounts in Tally is very easy and simple. It is much faster

than maintaining accounts for a company. The reason is that personal accounts

are comparatively very small and involve only a few amounts of entries. Now

compare that to a fully-fledged company which is selling products and includes

all kinds of accounting entries and on the top of that, there is GST accounting

entries too. But when you maintain personal accounts in Tally, there is

generally no GST involved and you need to just focus on your balance sheet. So,

let’s get started step by step.

Maintain Personal Accounts in Tally

When you have to maintain personal accounts in Tally, you

should mainly focus on balance sheet. There is a specific reason for that. In

personal account, there is no business account involved because it is your

personal accounts. Therefore, there is NO need for a Profit and Loss Account.

If you have a business, It is recommended that you maintain accounts of your

business separately and not mix the business accounts with your personal

accounts. By this you will have a clear understanding of where your business

stands and where your personal assets stand. Here is what the Balance Sheet

looks like of a person who has created his or her personal accounts in Tally

for the first time.

Opening Balance Sheet in Tally

You can see the balance sheet only if you have created a

company in Tally. Also, I have created a capital account by my name and altered

the opening balance of cash account. Here is how you can do it.

· From

Gateway of Tally, go to Accounts Info.

· Go

to Ledgers.

· Select

Create under Single Ledger.

· Create

a ledger by your name and it will be under Capital Account.

Now, we will alter the opening balance of Cash Account since

Cash Account is by default created in Tally. So to alter it, you need to come

one step back to ledgers menu in the above process.

·

Instead of Create under Single Ledger, select Alter.

·

Select Cash from the List of Ledgers.

· Cash

account will be under Cash-in-Hand.

· Go

down to the Opening Balance section and put the amount to ₹2,00,000.

Now, go the Balance Sheet from the Gateway of Tally and see

how it looks. Look the capital account on the left hand side of the Balance

Sheet which is in my name. On the right hand side which is called the Asset

side, there is cash.

This is a simple Balance Sheet looks like.

· Left

Hand Side = Liabilities Side = Capital = ₹2,00,000

·

Right Hand Side = Assets Side = Cash = ₹2,00,000

You brought in cash in the form of capital and hence cash

and capital are both increased by ₹2,00,000. This is the most basic form of

balance sheet. It is just an example through which I have explained the meaning

of the Balance Sheet to you. Now, in real life a person has certain assets and

liabilities as well. For example, generally a person has some assets like a

vehicle and a house, some investments like LIC, mutual funds and stock market

and some amount in bank account also (especially after demonetization). The

above was just the assets side. There will be certain liabilities as well. It

can be a housing loan, any kind of payment remaining unpaid like – house rent,

amount payable to stock broker and so on.

How to use Tally for Personal Accounting

Note: When you

buy something, it is a payment entry in Tally and therefore you have to select

Payment Voucher in Tally for that.

Let’s for example, you purchased a vehicle for ₹30,000 from the above cash of ₹2,00,000. The accounting entry in Tally for purchasing a vehicle will be as under:

Vehicle A/C Dr ₹30,000

To

Cash A/c ₹30,000

Create a ledger for Vehicle under Fixed Assets in Tally. If

you have a car or a two wheeler, the accounting entry will be same. With the

above entry, the balance sheet will be:

Now, we will do one more entry for Land. The entry for purchase of land in Tally will be:

Land A/c Dr ₹50,000

To

Cash A/c ₹50,000

Now, with another entry the balance sheet will be:

We still have ₹1,20,000 left after buying a vehicle and a

land for ₹30,000 and ₹50,000 respectively. Let’s do some investments. For

example, I want to buy mutual funds of ₹30,000 and gold for ₹50,000. The

entries in Tally for both the purchases will be as under:

Mutual Funds A/c Dr ₹30,000

To

Cash A/c ₹30,000

And

Gold A/c Dr ₹50,000

To

Cash A/c ₹50,000

The ledger of Mutual Funds will be under Investments.

Similarly, the ledger of Gold will also be under Investments.

Note: If you

invest your cash on some items, this will come under Investment.

The entry for buying Gold is also exactly the same as Mutual

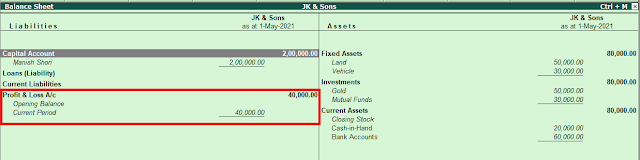

Funds. Now, the final balance sheet after these transactions is:

After buying Gold of ₹50,000, we left with Cash of ₹40,000.

Let’s deposit ₹20,000 in the bank account. I’ll create a ledger called Bank

under the group Bank Accounts.

Note: The entry

for depositing cash into a bank account is called a contra entry and therefore

we have to use Contra Voucher in Tally for passing this kind of entry. Bank to

bank transaction is also performed through Contra Voucher.

Whenever you deposit cash into a bank or withdraw cash from

a bank including ATM, you have to use Contra Voucher in Tally.

When you pass the entry, a new window with the bank name

appears, you can simply press enter to save the entry or you may change in this

window as date or any other information

As here I have made some changes

Now we have only ₹20,000 cash. Let’s check the balance sheet.

Just look at the Asset side of the Balance Sheet. All the

assets including Cash – where it came from? It primarily came from the capital

as of now which is on the Liabilities side in the form of Capital Account in my

name.

Note: If Service

Charges are your income, it will be under Direct Incomes. If you are selling

the services, it will be under Sales Accounts. If it is your expenses, it will

be under Direct Expenses.

Capital Account in Tally - Most Important for Personal Accounts

Let’s assume you are doing a job and you receive a salary of

₹20,000 a month in your bank account after all the deductions except TDS. The

salary entry in Tally for a month will be as under:

Bank A/c Dr ₹20,000

To

Salary A/c ₹20,000

Note: Salary will

come under Direct income Group because it is your income.

When you pass the salary entry, the same bank account window

will open.

As you pass the entry, you can see that in the column named

Received from, there Salary will come by default.

This is just one month salary and you have pass this same

entry with the date when you receive the salary for each month. So, every year

you will have to create 12 entries for salaries. As you are receiving the

salary, it will be a receipt entry in Tally. You can look at the pink badge and

it says Receipt. You can choose different accounting vouchers from the right

hand green bar along with its shortcuts in Tally. For example I have entered

the two months' salary in the bank and it will increase the capital account. But

still it does not show in the balance sheet, it will display in the profit and

loss account because we have created the salary ledger under Direct Income. As

But if we create salary ledger under capital account, it

will show record under the capital account. As I alter the salary ledger from

direct income to capital account

Note: Salary is

showing under Capital Account because the ledger for salary will be under

Capital Account when you are writing your own personal accounts. Salary

increases your capital and thus it can also comes under the capital account in

Tally.

At the end...

One more thing you should notice is that if you have done

correct accounting, the assets side and liabilities side will always be equal.

In our case, the salary increased by ₹2,40,000 and on the liabilities side, the

bank account increased with the same amount.

You can also see the video regarding How to create Personal Account in Tally:

Comments

Post a Comment