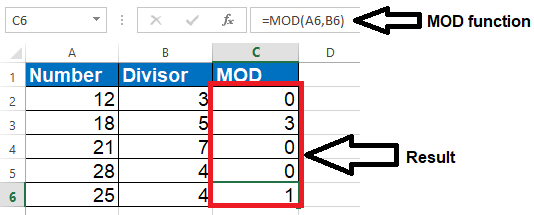

MOD function

Introduction The MOD function is categorized under Excel Math and Trigonometry functions. The function helps find a remainder after a number (dividend) is divided by another number (divisor). As a financial analyst, the function is useful when we need to process every n th value. For example, if our data comprises several columns of numbers, we can use MOD to sum every n th column. The Excel MOD function returns the remainder of two numbers after division. For example, MOD(10,3) = 1. The result of MOD carries the same sign as the divisor. Purpose Get the remainder from division Return value The remainder Syntax =MOD (number, divisor) Arguments · number - The number to be divided. · divisor - The number to divide with. Usage notes Use the MOD function to get a reminder after division. For Example, MOD (3,2) returns 1, because 2 goes into 3 once, with a remainder of 1. Examples, Here are a few examples of the MOD function with hardcoded v...